As a Kenyan web developer, I know how frustrating it can be when your application for a payment gateway is declined. Finding the right solution that suits your business needs can be challenging, especially with so many options that all claim to be the best. Some gateways may not accept businesses due to factors like being new, location restrictions, or specific industry requirements.

From what I’ve observed, the importance of reliable payment gateways in Kenya cannot be overstated. Recent data shows that 69% of Kenyan businesses have seen significant benefits from adopting digital payments, reporting improvements such as easier tracking of finances, quicker transactions, and reduced errors from cash handling.

This highlights how crucial it is to have a robust payment gateway, especially as more businesses shift away from cash-based operations. The shift is not just about convenience; it is about staying competitive and meeting customer expectations in an increasingly digital marketplace.

Understanding what a payment gateway is and how it differs from a payment method is also key. While a payment method refers to how customers pay, such as credit cards or mobile money, a payment gateway is the technology that processes and authorizes those transactions. It ensures payments are securely transferred to your business account, handling everything from encryption to fraud prevention. This behind-the-scenes work makes a payment gateway essential, particularly for large-scale developers and businesses looking for secure, reliable solutions.

In this article, I will walk you through 14 of the best payment gateways in Kenya. Each has been chosen for its ability to meet various business needs. To make it easier for you, I have included a comparison table that highlights each gateway’s strengths and features.

1. ipay Africa

iPay Africa has earned its place as one of the best payment gateways in Kenya, offering a flexible and secure platform for businesses. In 2023, iPay introduced Tap Ulipe, a contactless payment feature developed in partnership with Visa. This allows businesses to accept payments directly via smartphones or portable devices using Near-Field Communication (NFC) technology, which eliminates the need for expensive POS systems.

Merchants can use the Tap Ulipe app to process payments quickly and easily, making it particularly useful for small and medium-sized businesses (SMEs) looking for a cost-effective way to manage transactions.

Tap Ulipe has been instrumental in helping businesses speed up settlements while minimizing costs. This feature also fits well into iPay’s broader strategy of promoting digital payments in Kenya. The solution aims to boost accessibility and convenience for businesses and customers alike by making it easier to accept payments without bulky hardware.

For developers, iPay Africa provides APIs that integrate easily into websites and mobile apps. These APIs support a wide range of payment methods such as Visa, MasterCard, M-Pesa, and Airtel Money. With iPay’s clear documentation, businesses can customize the payment process to fit their needs, whether managing one-time purchases or recurring transactions. The STK-Push feature allows businesses to trigger mobile payment prompts directly to customers, simplifying the checkout process.

In terms of security, iPay ensures all transactions are safe, backed by PCI DSS compliance and its collaboration with Visa. This ensures both merchants and customers are protected from potential fraud, making it a trusted choice for handling payments in Kenya.

Why Businesses Choose iPay Africa:

- Tap Ulipe: This feature allows businesses to accept contactless payments through smartphones, making transactions more accessible and reducing costs for businesses.

- Flexible Payment Options: Supports Visa, MasterCard, M-Pesa, and Airtel Money, providing businesses with a wide range of payment options.

- Mobile-First Design: With NFC technology, iPay ensures seamless mobile payments that cater to modern consumer preferences.

- Developer Integration: iPay offers APIs that are easy to integrate, allowing businesses to quickly set up payment gateways on their platforms.

- Security Focus: Backed by PCI DSS compliance and Visa, iPay offers strong protection for secure transactions.

Considerations:

- Transaction Fees: Like most payment gateways, businesses need to evaluate how transaction fees might impact their margins, especially for high-volume payments.

- Initial Setup: Businesses without a technical team may require some assistance with setting up APIs and integrating iPay into their systems.

- Business Eligibility: From my experience, iPay Africa seems to focus more on established and larger businesses, which can be challenging for startups trying to get accepted. While this may not be an issue for more mature companies, startups might find it difficult to gain approval.

iPay Africa continues to be a top choice for businesses in Kenya, especially those looking for a cost-effective, scalable, and secure payment gateway. With innovations like Tap Ulipe and easy-to-use developer tools, iPay stands out as one of the best platforms for digital payments in 2024.

2. DPO Group

DPO Group ranks among the best payment gateways in Kenya, offering secure and reliable services for businesses across various industries. A feature that has greatly contributed to its popularity is the Real-Time Settlements, introduced in 2020. This feature ensures that businesses, particularly small and medium-sized enterprises (SMEs), can access their funds immediately after a transaction is completed.

This faster access to payments helps businesses maintain smoother operations by improving cash flow without the delays that traditional settlement methods often cause.

For developers, DPO Group provides developer-friendly APIs that make integration into websites and mobile apps straightforward. These APIs work seamlessly with popular eCommerce platforms like WooCommerce, Shopify, and Magento. Developers can easily customize payment solutions, thanks to DPO’s clear documentation and support, making it ideal for businesses that need flexibility and quick setup without extensive technical expertise.

Another valuable feature is the Prepaid Business Card, which allows businesses to access their payments instantly in local and international currencies, including USD. This makes DPO a convenient choice for businesses operating across borders.

Security is a core strength of DPO Group, with the platform being PCI DSS Level 1 Certified. This certification ensures that customer data and transactions are secure. Additionally, DPO has advanced fraud detection systems in place, which helps protect businesses from potential security threats.

Why Businesses Choose DPO Group:

- Real-Time Settlements: Instant payment access after transactions, crucial for businesses needing quick fund availability.

- Developer-Friendly Integration: Seamless API integration with platforms like WooCommerce, Shopify, and Magento, giving developers flexibility and ease.

- Prepaid Business Card: Provides immediate access to funds for both local and international payments, making global transactions simpler.

- Multiple Payment Methods: Supports Visa, MasterCard, M-Pesa, and Airtel Money, allowing businesses to offer diverse payment options to customers.

- Secure Transactions: PCI DSS certification and fraud detection systems ensure the security and safety of all transactions.

Considerations:

- Transaction Fees: Depending on the volume, businesses should consider how transaction fees may impact overall costs.

- Technical Setup: While the integration process is designed to be simple, some businesses may require assistance during the initial setup.

DPO Group continues to be a top contender in the Kenyan payment gateway space due to its focus on real-time payments, developer-friendly APIs, and robust security. These features make it an excellent option for businesses looking to streamline their payment processes while ensuring security and flexibility.

3. Paystack

Well, when talking about payment gateways in Kenya, Paystack is a standout choice. In 2024, they stepped up their game with features designed specifically for the Kenyan market, including the Virtual Terminal. This makes it easy for businesses to accept in-person payments using QR codes, skipping the need for costly POS systems. Customers just scan the code and can pay with options like M-Pesa, Visa, Mastercard, American Express, or Apple Pay. Payment confirmations are sent instantly via WhatsApp, which keeps things quick and hassle-free.

Paystack’s multi-currency support, handling both KES and USD, helps businesses manage both local and international transactions seamlessly. This works well for one-time purchases and subscription payments. The integration with platforms like Shopify and WooCommerce is smooth, making it easier for businesses to get started without extra effort.

Security is one of Paystack’s strongest points, with PCI DSS compliance and strong encryption protecting every transaction. The built-in fraud detection adds an extra layer of trust, giving both businesses and customers peace of mind. Developers will find the API easy to work with, making it simple to create custom payment setups.

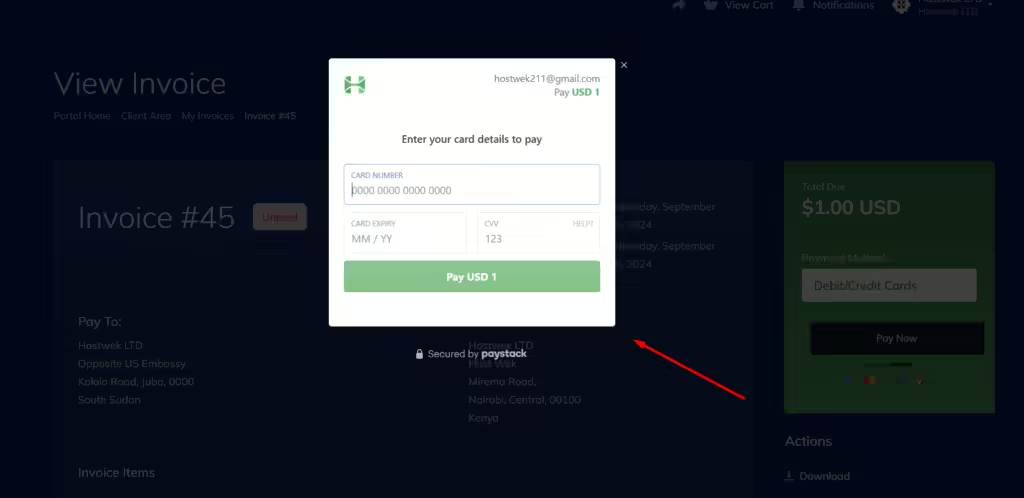

As a web developer, one of the things I’ve really appreciated about Paystack is their WHMCS module. The design is clean and modern, with intuitive pop-ups and a boxed layout that makes it user-friendly. Although Paystack’s M-Pesa integration may not be as extensive as IntaSend’s, it’s one of the best choices for credit card payments in WHMCS.

The real-time dashboard is another big plus, letting businesses keep track of transactions, manage refunds, and access detailed reports to stay on top of financial operations.

Why Businesses Prefer Paystack:

- Virtual Terminal: This feature transforms the way businesses handle in-person payments. By using QR codes instead of traditional POS systems, businesses save on hardware costs and create a more flexible, mobile payment experience for their customers.

- Multiple Payment Methods: Paystack supports various payment options, including M-Pesa, Visa, Mastercard, and Apple Pay. This variety ensures businesses can cater to diverse customer preferences, enhancing convenience and boosting customer satisfaction.

- Flexible Currency Support: With the ability to handle transactions in both KES and USD, Paystack allows businesses to easily serve local and international clients. This multi-currency capability is crucial for businesses looking to expand their reach without worrying about currency barriers.

- Developer-Friendly Integration: Paystack’s APIs and plugins are designed to be intuitive, making integration with websites and apps straightforward. This is particularly helpful for developers who need a payment system that is easy to customize and implement quickly.

- Secure Transactions: Security is a core focus, with PCI DSS compliance, strong encryption, and advanced fraud detection keeping all transactions secure. This reassures both businesses and their customers that sensitive payment data is well-protected.

Things to Consider:

- Transaction Fees: While Paystack offers a robust service, businesses need to evaluate how the transaction fees might affect their profit margins, especially if they process a high volume of payments.

- Technical Setup: Although Paystack’s integration is user-friendly, businesses without in-house technical expertise might require support to get set up and running smoothly.

- M-Pesa Options: For businesses where M-Pesa is the primary payment method, it’s worth exploring other platforms like IntaSend, which may offer more extensive M-Pesa features tailored to local needs.

Paystack’s combination of modern features, strong security, and flexible payment solutions makes it a dependable choice for Kenyan businesses aiming to streamline their payment processes in 2024.

4. IntaSend

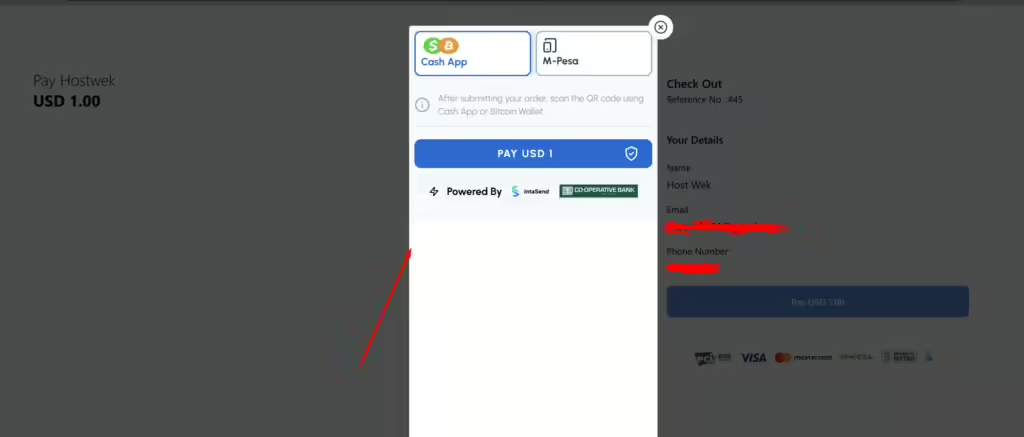

IntaSend takes the fourth spot in 2024, thanks to its impressive improvements that make it a top choice for businesses in Kenya. Developers are often amazed by how user-friendly IntaSend is. Having worked with it myself, I’ve set it up for clients and seen firsthand how well it handles local payments and Bitcoin transactions. For those who support CashApp, IntaSend’s integration provides a reliable solution that stands out in the market.

Over 5,501 businesses and developers use IntaSend to manage payments through M-Pesa, Visa, Mastercard, bank transfers, and Bitcoin. This range of payment options makes it easy for businesses to meet various customer needs.

One highlight is IntaSend’s WHMCS module, which supports M-Pesa and CashApp payments with a secure and seamless design. The module’s polished interface and strong security features offer an enhanced user experience.

For businesses working with international clients, IntaSend simplifies things by automatically converting payments into Kenyan Shillings. This eliminates the hassle of manual currency conversion, which is especially valuable when handling payments through ACH, credit cards, or Bitcoin.

IntaSend’s platform is a favorite among developers, thanks to detailed guides and tools that make integration into websites and apps straightforward. For businesses without tech teams, IntaSend offers no-code tools like payment links and smart invoicing, which allow payment management directly from the dashboard.

Fast payouts are a huge advantage. Mobile money and Bitcoin payments are processed instantly, while card payments settle within 2-3 days. This helps maintain cash flow, which is vital for everyday business operations.

Security is a top priority at IntaSend, with PCI-DSS compliance and fraud detection ensuring transactions are protected. Dynamic routing further optimizes the payment process by reducing delays and keeping things running smoothly.

Why Businesses Choose IntaSend:

- Variety of Payment Methods: Supports popular options like M-Pesa, Visa, Mastercard, bank transfers, and Bitcoin, covering both local and international needs.

- Developer Resources: Detailed API guides and SDKs make it easy for developers to integrate IntaSend into apps and websites.

- No-Code Payment Solutions: Businesses without tech teams can use IntaSend’s no-code tools for straightforward payment management.

- Fast Access to Funds: Instant processing for mobile money and Bitcoin payments, with card payments settling quickly.

- Simplified International Payments: Automatically converts international payments to Kenyan Shillings, reducing manual work.

- Strong WHMCS Module: Offers one of the best WHMCS modules for M-Pesa and CashApp, with a secure, user-friendly design.

IntaSend’s strong developer focus, solid support, and flexible features make it a top choice for Kenyan businesses looking to enhance their payment systems in 2024. Whether it’s local payments or international transactions, IntaSend offers reliability and innovation that set it apart.

5. Kora (formerly Korapay)

Kora started in 2017 as a remittance service before shifting to B2B payment solutions in 2019. Since then, it has grown steadily, offering secure and reliable payment options for businesses of all sizes in Kenya and across Africa. By 2024, Kora has established itself as one of the leading payment gateways in both Kenya and Africa, enabling businesses to manage local and international transactions with ease.

Beyond Kenya, Kora has expanded to key markets like Nigeria, South Africa, Ghana, and Cameroon. It’s also available in the USA, operating in 12 states, which allows businesses to use different payment methods such as mobile money (M-Pesa), credit and debit cards, bank transfers, QR codes, and USSD. Kora is quickly becoming a top choice for businesses not only in Africa but globally.

In March 2023, Kora launched USD card-acquiring, enabling merchants to accept payments in US dollars, which has significantly boosted cross-border transactions. This development allows African businesses to easily participate in global trade.

By simplifying multi-currency payments and introducing cross-border payment features, Kora has reinforced its role in supporting Africa’s digital economy, making payments easier and more accessible for businesses both locally and internationally.

For businesses looking to expand beyond local markets, Kora’s support for global payments makes it easier to reach customers worldwide. This feature enables Kenyan businesses to accept payments from around the world, expanding their operations and reaching new customers.

Many developers appreciate how Kora simplifies integration with popular platforms like WooCommerce, WordPress, Joomla, and Drupal. The APIs and plugins are user-friendly, and with the help of clear guides and regular updates, businesses can easily set up Kora on their websites or mobile apps. The necessary resources are readily available on Kora’s GitHub page, allowing developers to get started smoothly.

Security is also a top priority for Kora. The platform is PCI DSS Level 1 certified, meeting global standards for protecting payment data. With encryption and fraud detection in place, businesses can feel confident that transactions are safe, giving peace of mind to both the company and its customers.

Why Businesses Choose on Kora:

- Multiple Payment Methods: Kora allows businesses to accept payments through several methods, including mobile money (like M-Pesa and MTN Mobile Money), debit and credit cards, bank transfers, and QR codes. This variety ensures that businesses can offer customers convenient ways to pay, helping to improve the overall payment experience.

- Global Payment Support: Kora simplifies international payments by supporting popular cards such as Mastercard, Visa, and Verve. This makes it easy for businesses to expand their customer base globally without the complications often associated with cross-border payments.

- Seamless Integration: Kora integrates smoothly with popular platforms like WooCommerce, WordPress, Joomla, and Drupal. Its APIs and plugins are user-friendly and come with clear guides, ensuring that businesses can get started quickly and without technical challenges.

- Intuitive Dashboard: The dashboard provided by Kora is simple to use, giving businesses a clear view of their transactions, real-time updates, and easy access to manage payments. This helps businesses stay organized and efficiently monitor their cash flow.

- Strong Security: Kora provides PCI DSS Level 1 certified security, ensuring that all transactions are protected through encryption and fraud detection measures. Businesses and customers can trust that their sensitive information is secure, offering peace of mind throughout the payment process.

Considerations:

- Transaction Fees: Kora charges 1.5% per transaction, capped at ₦2000 (around KES 390) for card payments. It’s important to check whether this fee structure is consistent across different regions. For example, businesses in Kenya might find variations based on local currency and payment methods.

- Feature Availability: While Kora is expanding rapidly, some advanced features may not yet be available in all areas. It’s a good idea to verify if the specific tools your business requires are supported in your region before fully relying on the service.

- Customer Support: Kora seems to offer one of the best customer support systems, but it’s always wise to test how responsive they are in your specific region. Efficient support is key to resolving any issues promptly and keeping your business running smoothly.

Kora continues to grow as a reliable payment solution for businesses in Kenya and Africa. By simplifying both local and global transactions, Kora makes it easier for businesses to focus on growth and expansion while ensuring secure, smooth payment management for their customers.

6. PesaPal

PesaPal stands out as one of the best payment gateways in Kenya, providing businesses with a secure and flexible platform to handle payments. It supports multiple payment methods, including Visa, MasterCard, M-Pesa, and Airtel Money, which makes it suitable for various industries, from eCommerce to hospitality.

A key update in 2023 was the introduction of Real-Time Settlements through the Openfloat e-wallet system. This feature enables businesses to access their funds immediately after transactions are completed, helping small and medium-sized enterprises (SMEs) manage cash flow more efficiently. Along with this, PesaPal offers real-time tracking of payments, allowing businesses to keep an eye on their financial health easily.

For developers, PesaPal provides developer-friendly APIs that make it simple to integrate the payment gateway into websites and apps. The platform is designed to be flexible, with clear documentation available to guide developers in customizing payment systems to meet specific business needs. This makes it an excellent choice for businesses that require seamless integration and scalability.

PesaPal also ensures security through PCI DSS compliance and Central Bank of Kenya authorization, guaranteeing a high level of trust for businesses and customers alike. The platform’s focus on mobile-first experiences ensures smooth and convenient transactions for customers using smartphones, keeping up with the modern trend of mobile payments.

Why Businesses Choose PesaPal:

- Multiple Payment Options: Supports Visa, MasterCard, M-Pesa, Airtel Money, giving businesses flexibility in accepting payments.

- Real-Time Settlements: Businesses can access payments instantly through the Openfloat e-wallet system, improving cash flow.

- Developer-Friendly APIs: Clear documentation and flexible APIs make integration into websites and apps simple, with room for customization.

- Mobile-First Payments: Optimized for smooth transactions on smartphones, catering to the growing mobile payment trend.

- High Security: PCI DSS compliance and Central Bank of Kenya authorization ensure that transactions are safe and secure.

Considerations:

- WHMCS Module Issues: PesaPal’s WHMCS module has been reported to not function reliably. Users have raised concerns about module performance, and community discussions seem limited, leaving many without clear support.

- API Integration Support: While developer-friendly, some businesses may need assistance during initial setup.

- Transaction Fees: Costs can add up, especially for smaller businesses processing a high volume of transactions.

Despite these issues, PesaPal remains a valuable option for businesses in Kenya that prioritize secure and scalable payment solutions. Its focus on real-time settlements, mobile optimization, and robust security makes it a strong contender in 2024.

7. Flutterwave

When looking at the best payment gateways in Kenya, Flutterwave stands out for its wide range of services and ability to handle both local and international transactions.

In 2023, the company received name approval from the Central Bank of Kenya for a payments and remittances license, which will allow it to facilitate cross-border payments more efficiently once the full license is granted. That same year, Flutterwave committed KSh 7.3 billion (about $50 million) to expand its infrastructure and operations in Kenya.

Earlier, in 2022, Flutterwave introduced Google Pay to its platform, further enhancing the variety of payment methods available to businesses. Now, with options like mobile money, card payments, and bank transfers, Flutterwave offers businesses flexibility in how they handle payments, both locally and internationally.

From a developer’s perspective, Flutterwave’s APIs are straightforward to integrate, allowing businesses to manage one-time payments, recurring billing, and mobile money transactions with ease. The platform’s comprehensive documentation ensures that developers can quickly set up and customize the payment system to meet the specific needs of their business.

Security is a key strength for Flutterwave, with PCI DSS certification and fraud detection systems in place to protect businesses and their customers during every transaction.

The company’s ongoing innovation and growth have earned it significant recognition. Most recently, Flutterwave was named Fintech of the Year at the African Banker Awards, reflecting its leadership in the fintech space. The company was also highlighted on the CNBC Disruptor 50 list and recognized by Fast Company for its innovative contributions.

Why Businesses Choose Flutterwave:

- Wide Payment Options: Mobile money, card payments, bank transfers, and Google Pay give businesses a broad range of payment methods to offer customers.

- Developer-Friendly Integration: Flutterwave’s APIs are simple to implement, helping developers create and customize payment systems quickly.

- Strong Security Measures: PCI DSS certification and fraud detection systems ensure secure transactions for businesses and their customers.

- Cross-Border Payments: The upcoming full payments and remittances license will help streamline international payments, making it easier for businesses to expand globally.

Considerations:

- Transaction Fees: Businesses need to consider how transaction fees may impact their profitability, particularly when processing large volumes of payments.

- Technical Assistance: Though user-friendly, some businesses may require support during the initial integration process.

Flutterwave continues to grow as one of the best payment gateways in Kenya, offering secure and flexible payment solutions that are well-suited for businesses in 2024 and beyond.

8. Skrill

Skrill is a well-known online payment platform used by businesses in Kenya and around the world. Originally launched as Moneybookers, Skrill has grown to serve over 200 countries, making it a solid choice for businesses that need to process both local and international payments.

By 2024, Skrill continues to offer convenient solutions for Kenyan businesses, supporting various payment methods such as credit cards, bank transfers, and mobile wallets.

For businesses in Kenya, Skrill’s multi-currency support is a major advantage, allowing them to accept payments in over 40 currencies. This is especially helpful for companies dealing with international customers. Skrill also provides a Prepaid Mastercard, which enables users to access their funds directly for purchases or ATM withdrawals worldwide, making it easier for businesses to manage their finances.

In 2024, Skrill has enhanced its security features, ensuring that transactions are secure. With tools like two-factor authentication and advanced encryption, businesses can trust that their payments are safe from fraud. Skrill’s API is also easy to integrate, allowing developers in Kenya to add payment options to websites and apps without complications.

Skrill offers a user-friendly interface, making it simple for both businesses and customers to use. It’s also known for low fees on international transfers, making it a cost-effective option for Kenyan companies that deal with cross-border transactions.

Why Businesses in Kenya Choose Skrill:

- Multi-Currency Support: Skrill supports over 40 currencies, making it ideal for businesses handling both local and international payments.

- Multiple Payment Options: Skrill accepts payments through credit and debit cards, bank transfers, and mobile wallets, giving businesses flexibility in how they receive payments.

- Enhanced Security: With strong encryption and two-factor authentication, Skrill protects businesses and customers from fraud.

- Developer-Friendly API: Skrill’s API is easy to integrate, allowing businesses to quickly add payment options to their websites or apps.

- Prepaid Mastercard: Skrill’s prepaid Mastercard gives businesses and individuals the ability to access funds directly from their accounts for purchases or ATM withdrawals worldwide.

Things to Consider:

- Transaction Fees: While Skrill offers competitive rates for international transfers, businesses should review the fees associated with currency conversion and withdrawals.

- Verification Process: The account verification process might take some time, which is necessary to access certain features.

Skrill continues to be a reliable payment platform for businesses in Kenya, offering secure and easy-to-use solutions for handling both local and global transactions in 2024.

9. JamboPay

JamboPay has become a dependable payment platform for businesses in Kenya, making it easier to handle transactions and integrate payment solutions. By 2023, the platform had introduced updates that make it easier for developers to work with, while offering businesses more flexibility.

With the integration of PesaLink, businesses can now make quick wallet-to-bank transfers. This is particularly helpful for companies managing bulk payments like payrolls. Developers will appreciate how smoothly this feature integrates into apps and websites through JamboPay’s easy-to-use API.

JamboPay also gained Payment Service Provider (PSP) authorization from the Central Bank of Kenya, ensuring secure and compliant transactions. This is a critical step for businesses handling digital payments, and developers benefit from the added security built into the platform.

JamboPay’s Mobile Virtual Network Operator (MVNO) license also opens up new opportunities. Beyond payments, businesses can use it for smart metering, vehicle tracking, and other IoT-based services, making it ideal for industries like transport and utilities.

Why Businesses Prefer JamboPay:

- PesaLink Integration: Enables real-time wallet-to-bank transfers, simplifying payroll and large payment processes with easy developer integration.

- PSP Authorization: Provides businesses with a secure, compliant payment gateway approved by the Central Bank, offering peace of mind and trusted transactions.

- MVNO Services: Allows businesses to manage operations like smart metering and vehicle tracking, combining operational and payment data into one system.

- E-commerce Platform: JamboPay.Market offers an easy way for SMEs to sell products online and accept mobile payments, with no need for complex setups.

Things to Consider:

- Transaction Fees: It’s important to review how JamboPay’s fees might impact overall costs, especially for businesses handling many transactions.

- Technical Setup: While the API is straightforward, some businesses may need help during the initial setup phase, particularly for more complex systems.

JamboPay continues to grow as a reliable, secure option for businesses in Kenya, providing flexibility and ease for both developers and business owners.

10. KopoKopo

KopoKopo has long been helping businesses in Kenya accept mobile payments, especially through M-Pesa and Lipa Na M-Pesa. Initially focused on small and medium enterprises (SMEs), it has expanded its services to offer more than just payment processing, making it easier for businesses to access financial services that help them grow.

One of the standout features is the cash advance service known as Grow, which gives businesses access to short-term loans based on their transaction history. This service helps businesses manage their cash flow without waiting for lengthy approval processes. For SMEs needing quick access to capital, this has proven to be a valuable tool.

For developers, KopoKopo’s API is easy to integrate, allowing businesses to add mobile payment options like M-Pesa and Airtel Money into their websites and mobile apps seamlessly. It also supports bulk payments, enabling businesses to efficiently manage payouts to suppliers or staff directly from their accounts.

In 2023, KopoKopo was acquired by Moniepoint, a development that has enhanced its ability to offer even more financial services, while maintaining the ease of use and security that businesses rely on. This acquisition is part of KopoKopo’s continuous growth and commitment to supporting Kenyan businesses with the tools they need to succeed.

Why Businesses Choose KopoKopo:

- Mobile Payment Support: KopoKopo works with M-Pesa, Airtel Money, and other mobile payment services, giving businesses multiple options for accepting payments.

- Cash Advance with Grow: The cash advance service allows businesses to access quick loans based on their transaction history, improving cash flow management.

- Bulk Payment Capabilities: Businesses can handle bulk payments to suppliers or staff, simplifying operational processes.

- Developer-Friendly Integration: KopoKopo’s API makes it easy for developers to integrate mobile payment options into apps and websites, ensuring smooth functionality.

Things to Consider:

- Transaction Fees: Like other platforms, it’s important to assess how KopoKopo’s fees might impact overall business costs, particularly for high-volume transactions.

- Loan Repayment: While the cash advance feature is useful, businesses need to plan for repayment carefully to avoid potential financial strain.

KopoKopo’s combination of payment solutions and financial services, supported by its 2023 acquisition, makes it a strong option for businesses looking to simplify payments and improve cash flow management.

11. Jenga

Jenga has become an important payment gateway for businesses in Kenya, allowing them to manage payments from a wide range of sources. Since its launch in 2018 by Finserve, a subsidiary of Equity Bank, Jenga has continued to grow, offering businesses a reliable solution for handling local and international transactions.

In 2024, Jenga remains a go-to platform for businesses processing payments from over 180 countries, supporting cards, mobile wallets, and bank transfers.

For developers, Jenga offers a straightforward API that makes it easy to integrate payment solutions into websites or mobile apps. The platform supports popular payment methods such as M-Pesa, Visa, and Mastercard, as well as digital wallets like PayPal and WeChat Pay, ensuring businesses can cater to a diverse range of customers.

Security is also a key focus for Jenga. The platform includes built-in fraud detection systems that help protect businesses from chargebacks and fraudulent activities. This is especially useful for companies processing large numbers of transactions, offering peace of mind when it comes to payment security.

Jenga’s ability to handle cross-border payments is another advantage. By supporting multiple currencies, businesses can easily manage international transactions without the complexity of currency conversions, making it a great option for those serving customers across different regions.

Why Businesses Choose Jenga:

- Multiple Payment Options: Jenga supports payments through cards, mobile money, and digital wallets, offering flexibility for businesses with various customer preferences.

- Simple API Integration: Jenga’s API is easy for developers to work with, allowing for quick and efficient integration into websites and mobile apps.

- Fraud Detection: Jenga includes tools to help businesses reduce the risk of chargebacks and fraud, providing additional security for payment processing.

- Cross-Border Payments: With support for multiple currencies, Jenga simplifies international payments, making it easier for businesses to handle global transactions.

- Real-Time Payment Tracking: The platform provides real-time tracking of payments, allowing businesses to manage cash flow more effectively.

Things to Consider:

- Transaction Fees: Businesses should review Jenga’s transaction fees to understand how they might affect overall costs, particularly for high volumes of transactions.

- Setup Support: While the API is straightforward, some businesses may need technical assistance during the integration process, especially for more complex setups.

Since 2018, Jenga has proven to be a reliable and secure payment platform, continuing to provide businesses in Kenya with the tools they need to manage both local and international transactions efficiently.

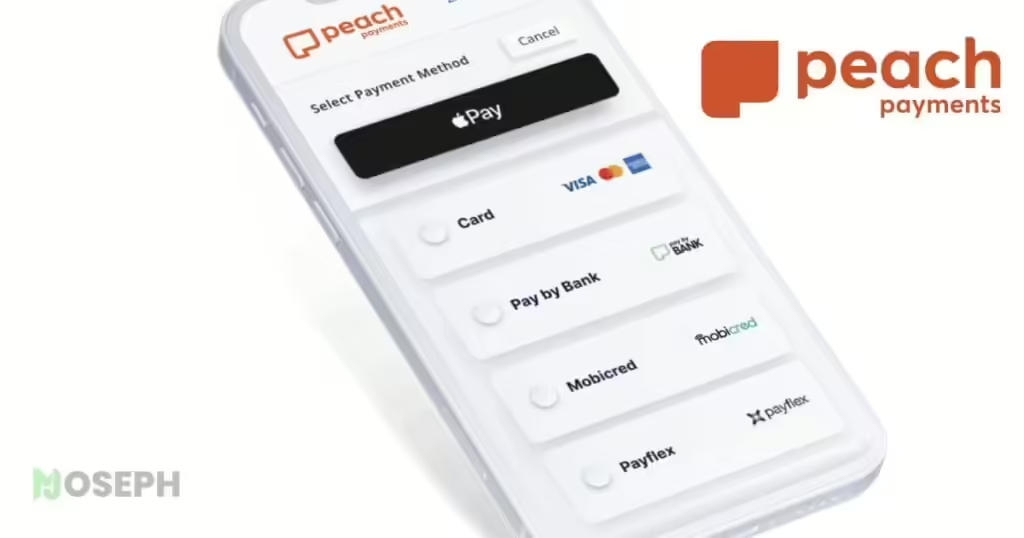

12. Peach Payments

Peach Payments has become a standout option for businesses looking for reliable and secure payment solutions in Kenya. Since expanding its services to Kenya in 2018, the platform has steadily grown, offering a range of payment services including credit card payments, mobile money, and digital wallets.

As of 2024, Peach Payments continues to evolve, providing even more advanced tools to help businesses process payments both locally and internationally.

Known for its strong security features, Peach Payments offers businesses two-factor authentication, fraud detection tools, and PCI DSS Level 1 certification. These measures help protect businesses from fraud and ensure that transactions are safe, whether you’re handling a large volume of local payments or managing cross-border transactions.

For developers, Peach Payments provides a seamless integration experience with its easy-to-use API and support for major e-commerce platforms like WooCommerce and Shopify. This allows businesses to quickly set up and manage payment solutions without unnecessary complications.

Another key advantage is its support for multi-currency transactions, which allows businesses in Kenya to easily accept payments from international customers. This flexibility makes Peach Payments one of the most effective platforms for businesses aiming to reach a global market.

Why Businesses Choose Peach Payments:

- Variety of Payment Methods: Peach Payments enables businesses to accept credit cards, mobile money, and digital wallets, giving customers more ways to pay.

- Robust Security: With advanced fraud detection and two-factor authentication, Peach Payments ensures that transactions are secure from start to finish.

- Developer-Friendly Integration: The platform’s API is simple to integrate, making it easy for businesses to incorporate Peach Payments into their existing websites or mobile apps.

- Multi-Currency Support: Peach Payments allows businesses to accept payments in different currencies, making international transactions smoother and more efficient.

- Flexible Payout Options: Peach Payments helps businesses manage payouts and subscriptions, making it easier to handle recurring payments or supplier transactions.

Things to Consider:

- Transaction Fees: It’s important for businesses to evaluate how Peach Payments’ fees, especially for international transactions, might impact their overall costs.

- Technical Setup: Although the API is user-friendly, businesses with more complex systems may need additional support during setup to ensure a smooth integration.

Peach Payments continues to be a top choice among the best payment gateways in Kenya, offering a secure and flexible platform for businesses to manage their payments efficiently in 2024.

13. Mpayer

Mpayer has grown into an essential payment gateway for businesses in Kenya, providing solutions for mobile payments through services like M-Pesa, Airtel Money, and Orange Money. This payment gateway is widely used by organizations with large customer bases, such as estates, churches, and service providers, allowing them to manage payments and customer engagement effectively.

Recently, Mpayer introduced improvements that continue to make it a trusted choice for businesses in 2024. It offers built-in SMS notifications, allowing businesses to keep customers informed with real-time payment updates. This feature enhances communication and strengthens customer loyalty, making it ideal for businesses that need ongoing engagement with their users.

Mpayer also offers flexibility with both online and offline payment options, ensuring that businesses can customize their payment setups to fit their unique needs. For developers, Mpayer’s API provides easy integration, enabling the automation of recurring payments and the real-time tracking of transactions.

Why Businesses Choose Mpayer:

- Wide Payment Support: Mpayer integrates with M-Pesa, Airtel Money, and Orange Money, allowing businesses to accept payments through a variety of mobile money services.

- Customer Communication: With built-in SMS notifications, businesses can maintain smooth communication by sending payment reminders and updates to customers.

- Developer-Friendly Integration: The API offers developers an easy way to integrate payment systems and automate recurring payments, streamlining operations for businesses.

- Great for Large Customer Bases: Mpayer’s tools are particularly suited for businesses handling high-volume or recurring payments, offering comprehensive tracking and management features.

Things to Consider:

- Advanced Payment Tracking: Mpayer provides detailed transaction tracking, which is crucial for businesses needing to monitor payments closely.

- Technical Support: Some businesses may need assistance when setting up or customizing Mpayer’s API to fit their specific requirements.

By continuing to innovate and adapt, Mpayer helps businesses in Kenya stay connected with their customers and manage payments efficiently, providing reliable solutions well-suited to the needs of 2024.

14. Africa’s Talking

Africa’s Talking is widely used by businesses in Kenya, allowing them to easily integrate M-Pesa, Airtel Money, and other local payment systems while managing customer communication through tools like SMS, USSD, and voice notifications. This combination helps businesses streamline their payment processes and keep customers informed in real-time.

By 2024, Africa’s Talking continues to serve as a vital resource for businesses needing flexible payment solutions. Its developer-focused APIs offer straightforward integration, enabling businesses to customize payment workflows and adapt the platform to their specific needs. This flexibility makes it a popular choice for companies of all sizes, especially those looking to scale and handle larger volumes of transactions.

The platform also places a strong emphasis on security, offering encryption and fraud detection measures to protect both businesses and their customers. These features are crucial for handling sensitive data and ensuring that transactions are secure.

The AT Summit remains a valuable platform for developers and business leaders, fostering innovation and collaboration around payment technology and mobile communications. This event ensures that users of Africa’s Talking are always up to date with the latest tools and trends in the industry.

Why Businesses Choose Africa’s Talking:

- Local Payment Integration: Africa’s Talking integrates seamlessly with M-Pesa and Airtel Money, making it ideal for businesses targeting the Kenyan market.

- Combined Payment and Communication Tools: The platform enables businesses to process payments while staying connected with customers through SMS and USSD notifications, simplifying interactions.

- Easy API Integration: The platform’s APIs are well-documented and easy to use, providing developers with the flexibility to tailor the system to meet the specific needs of their business.

- Scalable for Growing Businesses: Africa’s Talking supports businesses as they grow, handling increased transaction volumes without any drop in performance.

- Regional Expansion: With services available in several African countries, Africa’s Talking helps businesses manage payments and communications across borders.

Things to Consider:

- Technical Customization: While the platform offers flexibility, some businesses may need technical assistance to fully integrate and customize the solutions based on their operations.

Africa’s Talking continues to provide Kenyan businesses with practical solutions for handling payments and communication in 2024, making it a key platform for businesses looking to stay competitive.

Comparison Table: Best Payment Gateways in Kenya

As we conclude, here’s a comparison of the payment gateways available in Kenya for 2024. This table highlights key aspects like payment methods, security features, API flexibility, and the types of businesses each gateway is best suited for, helping you make an informed decision for your business.

| # | Gateway | Payment Methods | Security | API Options | WHMCS Support | Target Audience |

|---|---|---|---|---|---|---|

| 1 | iPay Africa | Visa, M-Pesa, Airtel Money, eLipa | PCI DSS, 3D Secure | Mobile and web integration | Confirmed WHMCS module available | Startups, SMEs |

| 2 | DPO Group | Visa, Mastercard, Amex, M-Pesa, Airtel Money | PCI DSS Level 1, 3D Secure | Scalable, detailed documentation | Confirmed WHMCS module available | Large Enterprises, Cross-Border Traders |

| 3 | Paystack | Cards, Mobile Money, QR, USSD | PCI DSS, SSL Encryption | Easy integration for web and mobile | Confirmed WHMCS module available | Tech Startups, E-commerce |

| 4 | IntaSend | Visa, Mastercard, M-Pesa, Bitcoin | PCI DSS, SSL Encryption | Developer-friendly, supports crypto | Confirmed WHMCS module available | Tech Startups, Global Payments |

| 5 | Kora | Visa, Mastercard, M-Pesa, Bank Transfers, QR Codes, USSD | PCI DSS Level 1, Advanced Fraud Detection | Easy integration, plugins for popular platforms | No WHMCS module available | Businesses of all sizes, International Transactions |

| 6 | PesaPal | Visa, MasterCard, Amex, M-Pesa, Airtel Money | PCI DSS, SSL Encryption | Moderate integration, basic customization | Confirmed WHMCS module available | SMEs, Hospitality |

| 7 | Flutterwave | Visa, Mastercard, M-Pesa, Mobile Money, USSD | PCI DSS, Anti-Fraud Detection | Highly flexible, great for custom solutions | No WHMCS module available | E-commerce, Startups |

| 8 | Skrill | Credit/Debit Cards, Bank Transfers, Mobile Wallets | PCI DSS, Two-Factor Authentication | Developer-friendly API | Confirmed WHMCS module available | E-commerce, International Businesses |

| 9 | JamboPay | Visa, Mastercard, M-Pesa, Airtel Money | PCI DSS, SSL Encryption | Comprehensive API | No WHMCS module available | Government, Utilities, SMEs |

| 10 | KopoKopo | M-Pesa, Airtel Money | SSL Encryption | Developer-friendly API | No WHMCS module available | SMEs, Retailers |

| 11 | Jenga | Visa, Mastercard, M-Pesa, Bank Transfers | PCI DSS, SSL Encryption | Developer-friendly API | No WHMCS module available | SMEs, Enterprises |

| 12 | Peach Payments | Credit/Debit Cards, Mobile Money | PCI DSS Level 1, Two-Factor Authentication | Developer-friendly API | No WHMCS module available | E-commerce, Subscription Services |

| 13 | Mpayer | M-Pesa, Airtel Money, Orange Money | PCI DSS, SSL Encryption | Developer-friendly API | No WHMCS module available | Organizations with large customer bases |

| 14 | Africa’s Talking | M-Pesa, Airtel Money | PCI DSS, SSL Encryption | Comprehensive API, developer-focused | No WHMCS module available | Developers, Startups |

I have also been getting some common questions from both my business partner and clients about payment gateways. I thought it would be helpful to answer a few of them here, as these answers could help you make a more informed decision for your business.

What is the difference between a payment gateway and a payment processor?

A payment gateway authorizes and processes payments from your website or app to the payment processor. It handles encryption and security checks to ensure a transaction is safe. A payment processor communicates between the customer’s bank and the business’s bank to move the money. The gateway manages secure data transfer, while the processor moves the funds.

Can small businesses afford payment gateway fees?

Yes, many payment gateways offer flexible pricing for small businesses. Platforms like IntaSend and PesaPal provide competitive rates and tiered options, with some charging per transaction instead of monthly fees. This makes them affordable for smaller operations. It’s best to check each provider’s pricing to find the right fit for your budget.

What documents do I need to set up a payment gateway in Kenya?

Most payment gateways require basic business documents, such as a certificate of incorporation, tax identification, and bank account information. Sole proprietors may need an ID, bank statement, and tax details. Each provider may ask for different documents, so it’s a good idea to check their setup requirements in advance.

How do I choose the right payment gateway for my business?

Start by looking at your business needs, such as local vs. international transactions, the payment methods your customers use, and your budget. If you handle mainly local payments, a gateway with M-Pesa support, like IntaSend, will be essential. For international sales, consider platforms that support global payments and multiple currencies, like Paystack. Also, check for ease of use, security features, and customer support quality.

Which payment gateways work well with WHMCS in Kenya?

For businesses using WHMCS, IntaSend and Paystack are standout options in Kenya. Both platforms have WHMCS modules that are known for their sleek design and reliable performance. This makes them excellent choices for web developers and businesses looking for seamless integration and a user-friendly experience.

What are the typical fees for using a payment gateway in Kenya?

Fees can vary depending on the platform and type of transaction. M-Pesa charges about 1-3% for local transactions, while Visa and Mastercard may charge 2.5-3.5%. For international transactions, such as using ACH or Bitcoin, fees may differ and can sometimes be more flexible. Always check each provider’s pricing page for accurate details.

How secure are payment gateways for online transactions?

Security is a priority for most payment gateways. IntaSend, Paystack, and Flutterwave use PCI-DSS compliance to keep transactions secure. They also include fraud detection and encryption to protect customer data. Many gateways also offer two-factor authentication for added security against unauthorized access.

Can I use more than one payment gateway on my website?

Yes, integrating multiple payment gateways is possible and often beneficial, especially if you serve both local and international customers. This allows you to offer more options, such as M-Pesa for local users and credit cards for international clients. However, using multiple gateways may require more technical setup.

How long does it take to set up a payment gateway?

The time to set up a payment gateway varies. Some, like IntaSend and Flutterwave, offer simple no-code tools that you can set up in under an hour. Others may require more time for integration and approval, especially if custom features are needed. Good documentation and responsive customer support can make the process faster.

Are there any hidden fees with payment gateways?

Some gateways may have additional fees, such as charges for chargebacks, currency conversion, or special payment methods. To avoid surprises, read the terms and conditions or ask a representative for a full breakdown of fees.

When choosing a payment gateway for your business in Kenya, the right decision can significantly impact how seamlessly your transactions are processed. Each of the options mentioned offers its own strengths, so it’s important to think about what suits your specific needs. Consider whether flexibility, stronger security, or easier integration is the most important factor for you.

If you’ve used any of these platforms or have insights to share, feel free to leave a comment below. Your experience could help others make a more informed decision.